CRED iQ Preliminary Analysis

Deal Overview

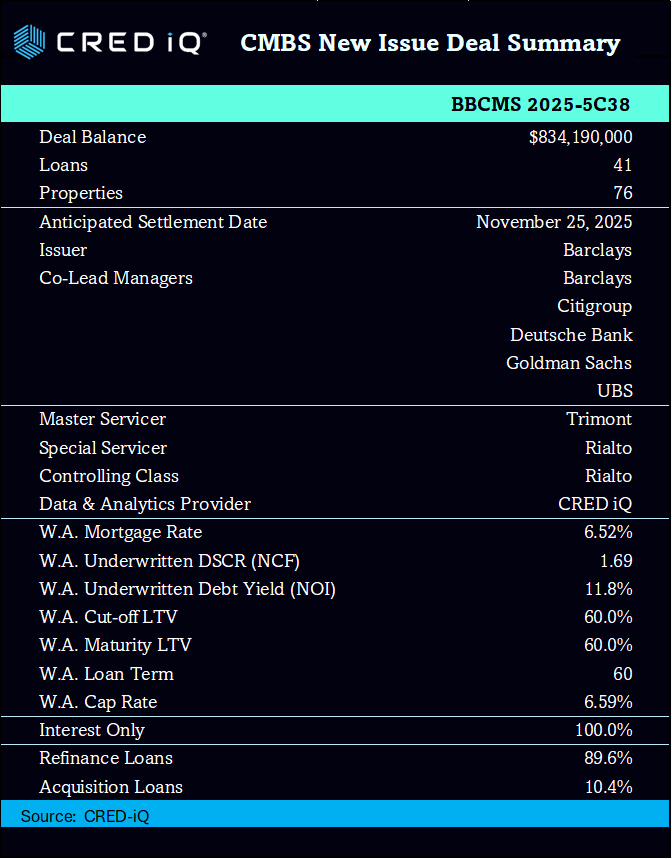

Type: Public fixed-rate conduit CMBS (primarily interest-only with limited partial amortizing loans)

Size: $588.7 MM publicly offered certificates (total trust balance: $588,699,194)

Issuance Date: Priced December 9, 2025 | Expected settlement December 23, 2025

Co-Lead Managers & Joint Bookrunners: Citigroup, Goldman Sachs & Co. LLC, Barclays, Deutsche Bank Securities

Co-Managers: Drexel Hamilton, Mischler Financial Group

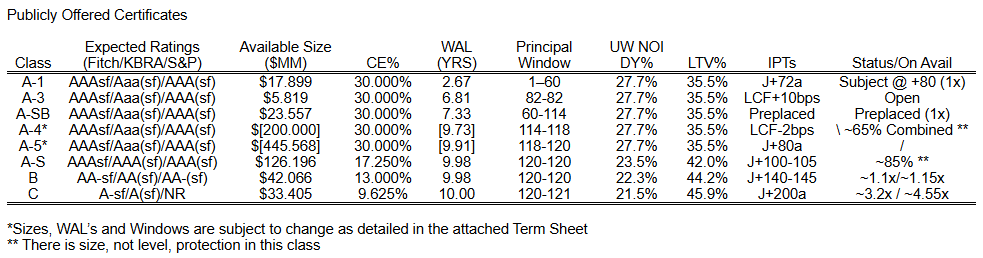

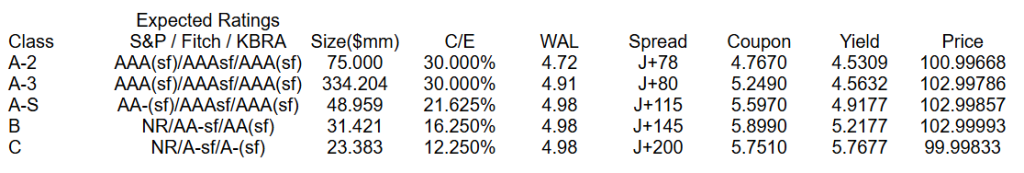

Pricing

Key Pool Characteristics

Initial Pool Balance: $588,699,194

Number of Loans / Properties: 28 / 48

WA Cut-off LTV: 61.6%

WA Maturity LTV: 61.6%

WA UW NCF DSCR: 1.71x

WA Debt Yield (UW NOI): 11.4%

WA Mortgage Rate: 6.286%

WA Remaining Term: 59 months

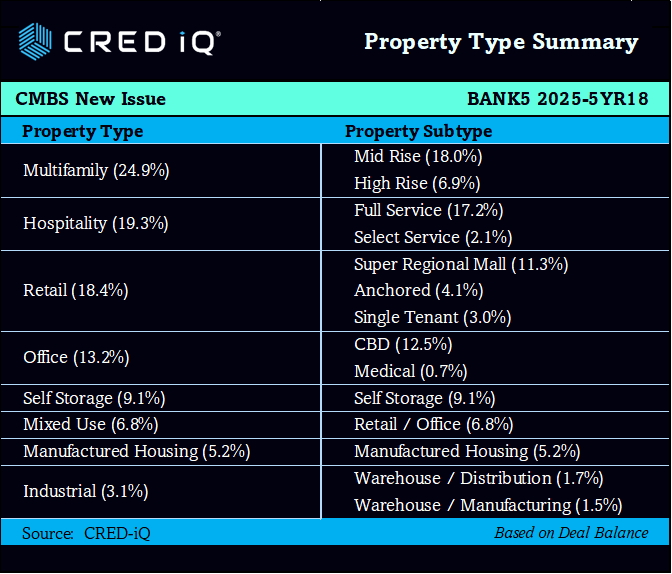

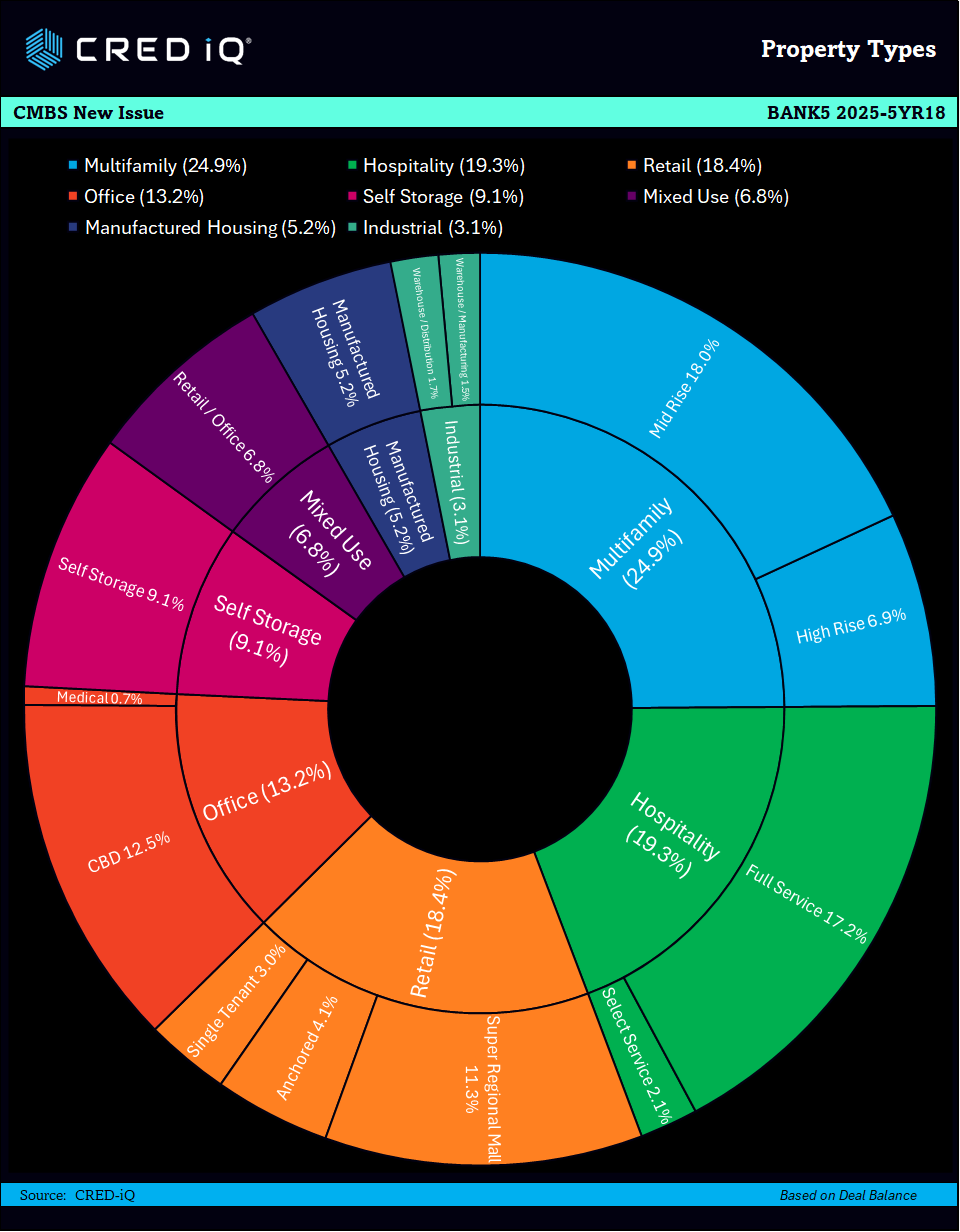

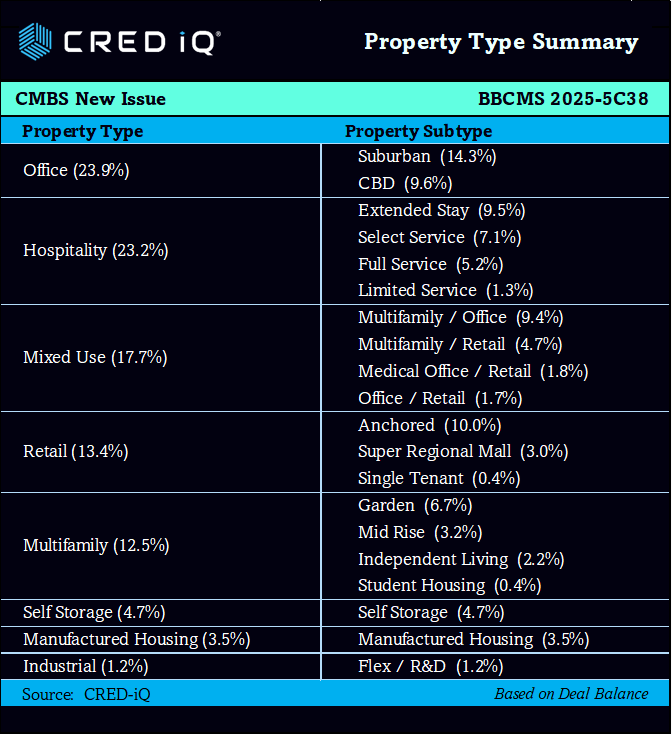

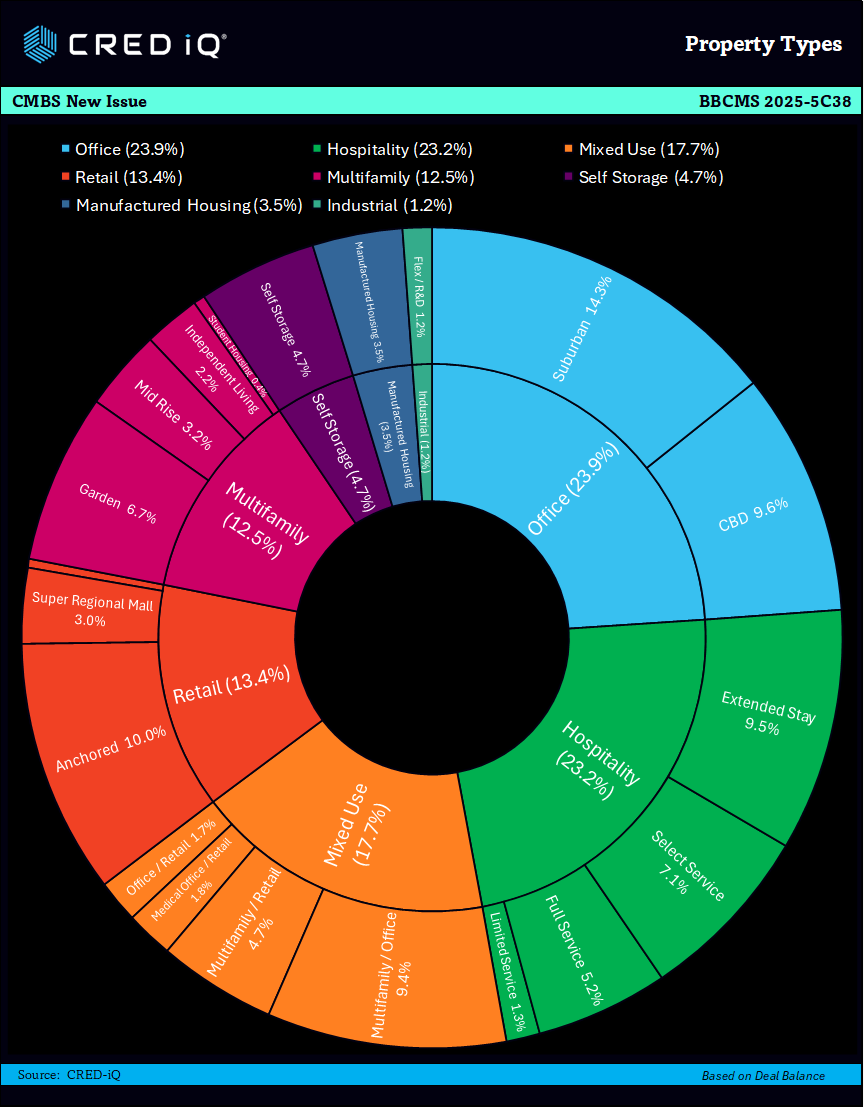

Property Type Mix

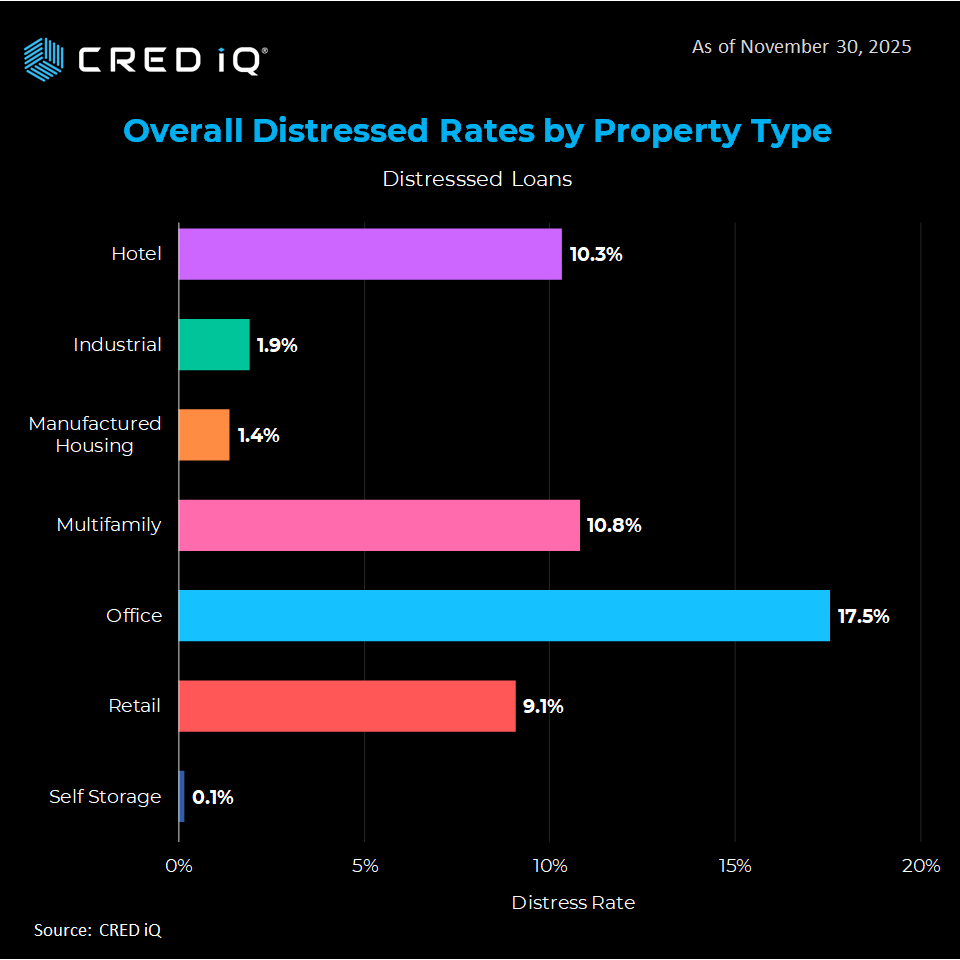

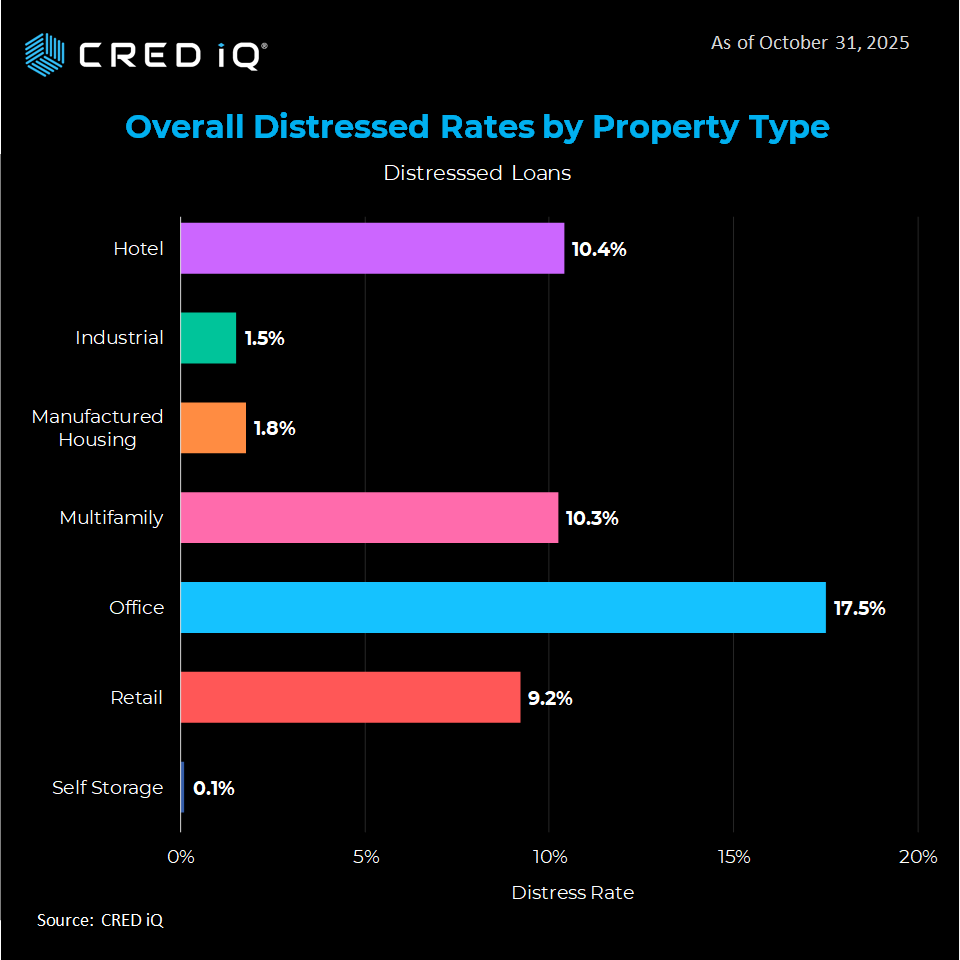

Retail 21.5% | Hospitality 18.7% | Self Storage 16.6% | Multifamily 16.0% | Industrial 13.8% | Office 8.7% | Manufactured Housing 4.7%

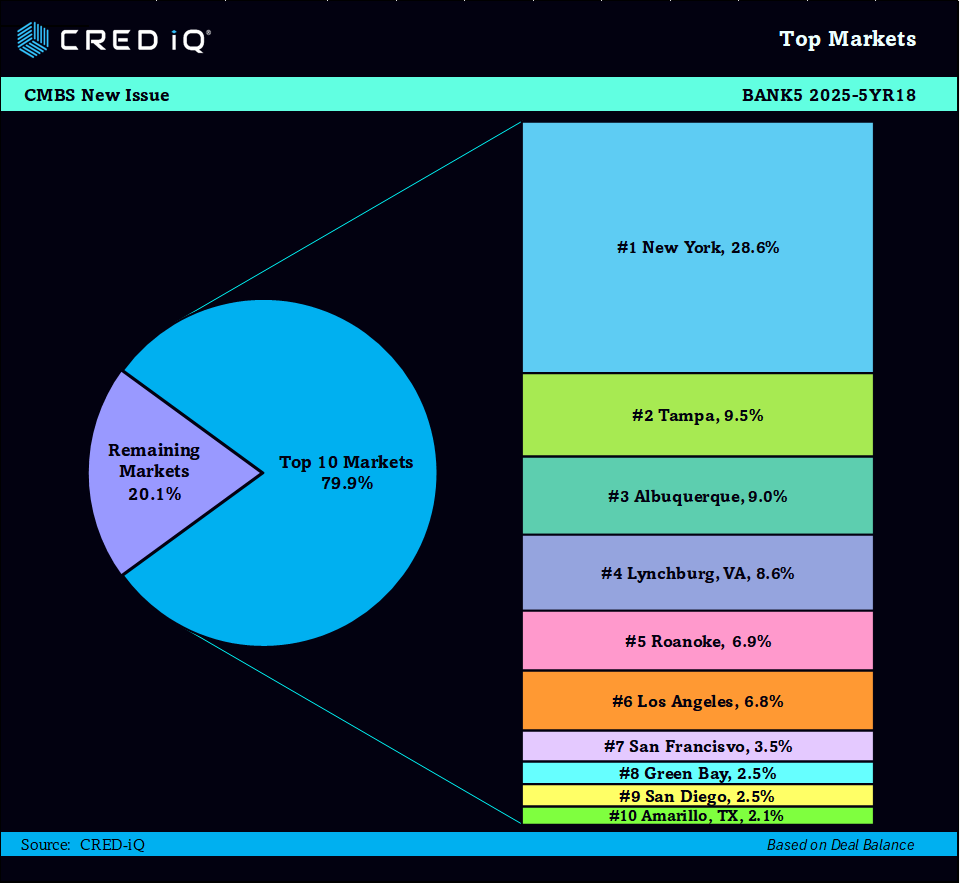

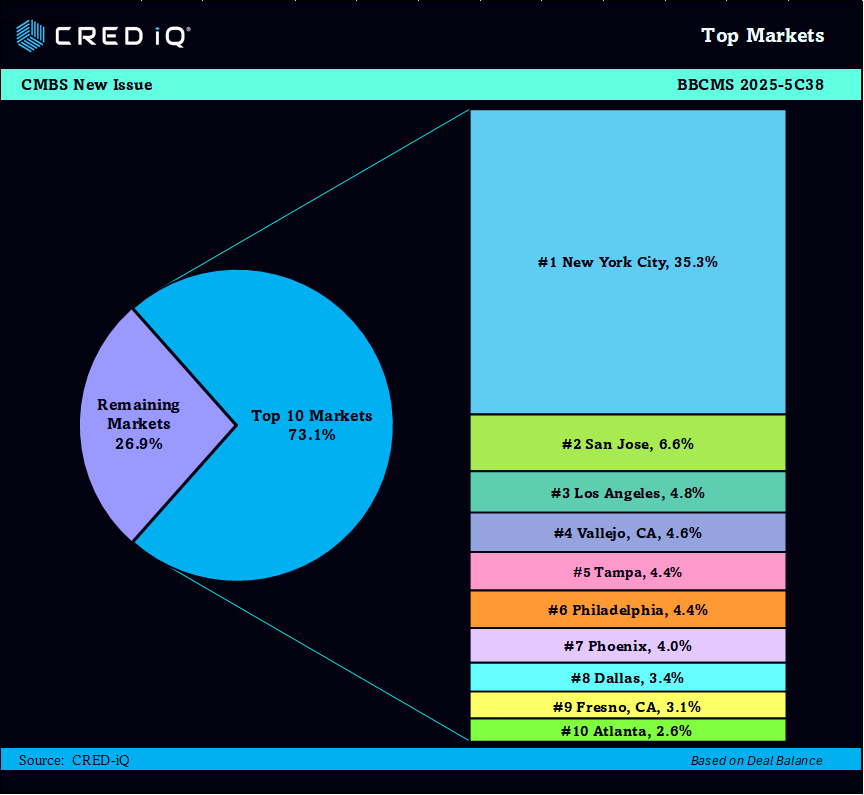

Geographic Concentration

CA 22.3% | NY 18.3% | SD 6.8% | DE 5.9% | FL 5.9%

Risk Retention: L-shaped (horizontal + vertical)

Anticipated Settlement: December 23, 2025

Servicing & Parties

Master & Special Servicer: Midland Loan Services (PNC)

Operating Advisor: Park Bridge Lender Services

Data & Analytics Provider: CRED iQ

Key Analysis

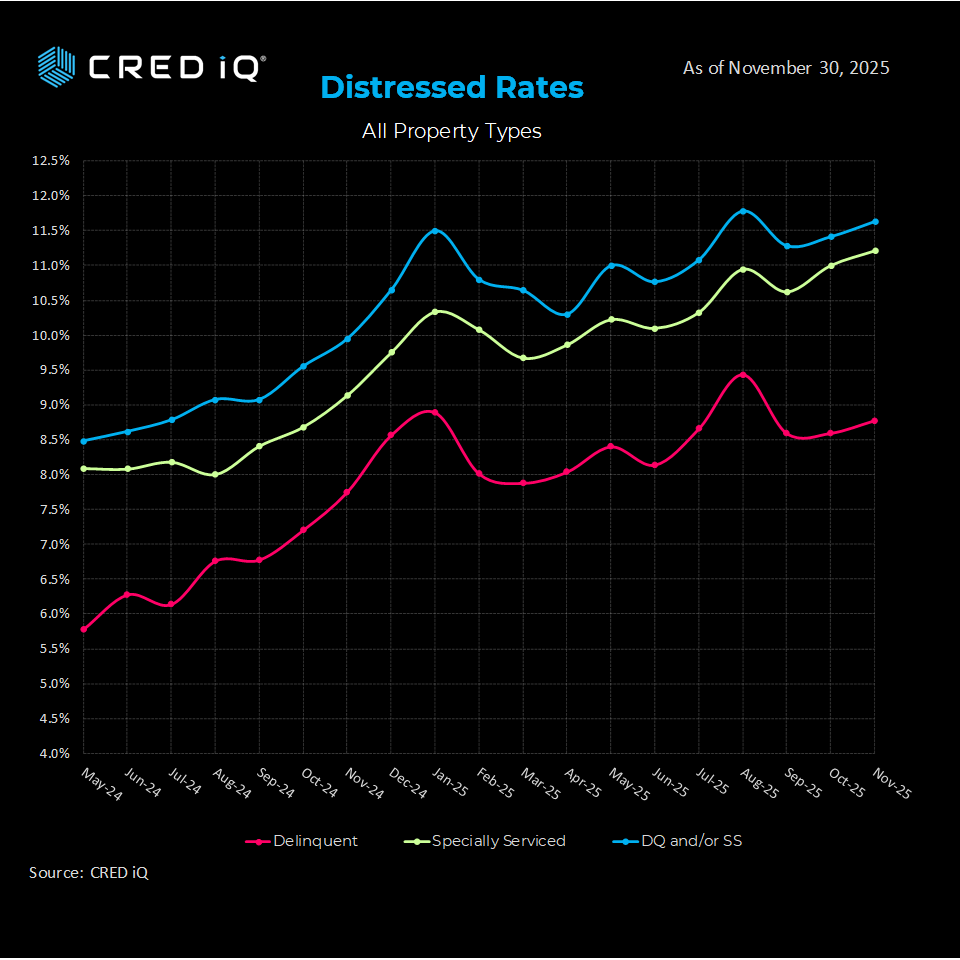

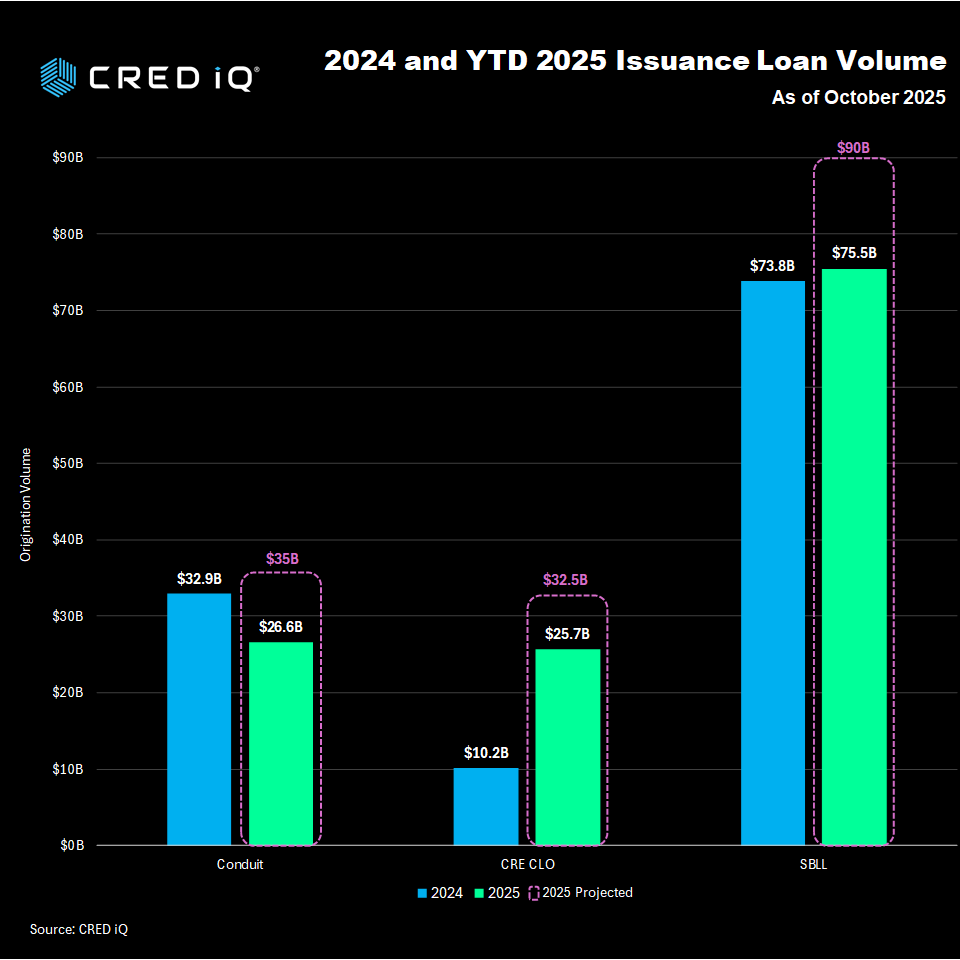

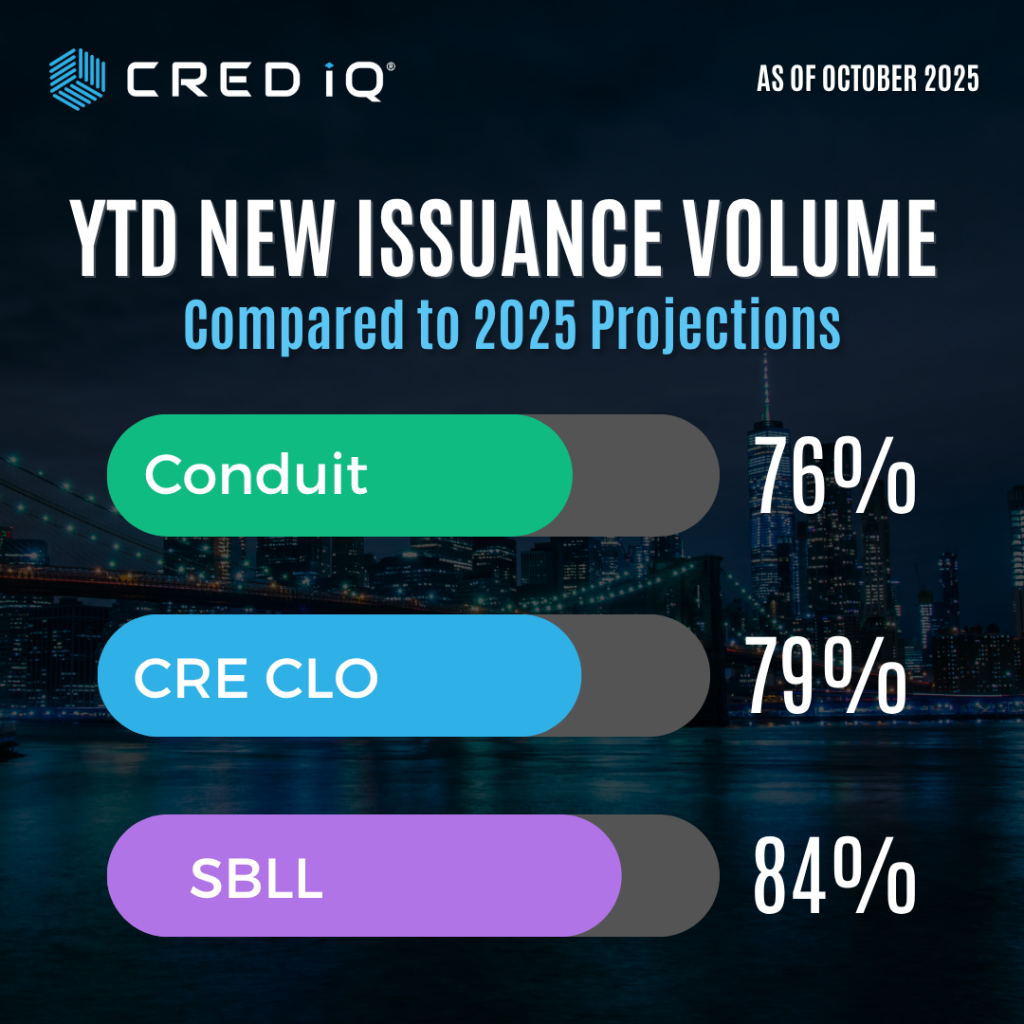

BMARK 2025-V19 closed out the 2025 conduit calendar on a strong note, with the entire stack pricing 5–20 bps inside initial guidance — a sign that late-year demand for floating-rate exposure remains robust despite the Fed’s recent rate cuts.

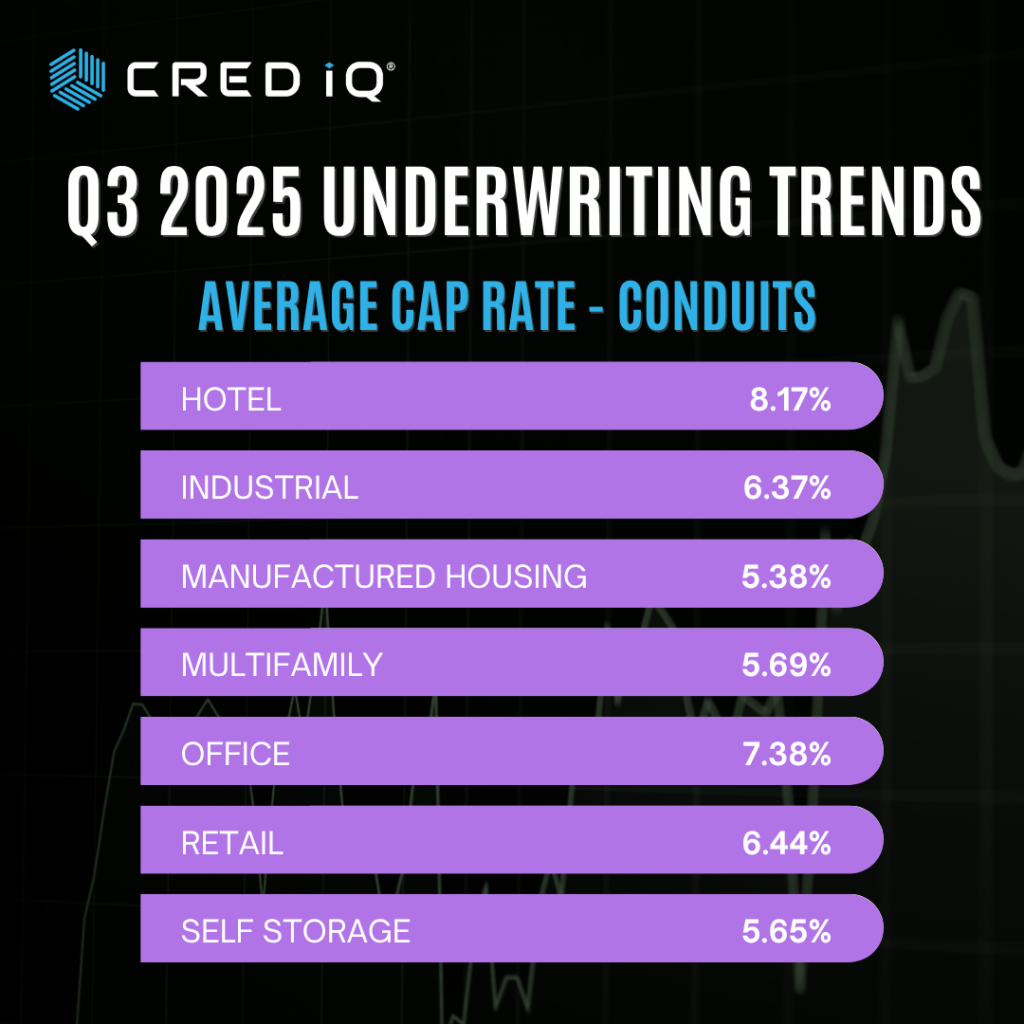

The deal’s 30% credit enhancement to the AAA classes is in line with recent Benchmark vintages and continues to reflect the conservative underwriting that has characterized post-2023 conduit issuance. A WA cut-off LTV of 61.6% with essentially no amortization (maturity LTV unchanged) and a solid 1.71x UW DSCR provide reasonable cushion against near-term stress.

Property-type diversity is better than many recent deals, with no single sector exceeding 22%. The heavier retail (21.5%) and hospitality (18.7%) allocations are notable but mitigated by strong debt yields (11.4% overall) and granular loan sizing (average ~$21 mm).Geographically, the 40.6% combined California + New York concentration is typical for year-end conduits, though the 6.8% South Dakota exposure (likely tied to a large self-storage portfolio) adds an unusual Midwestern tilt.

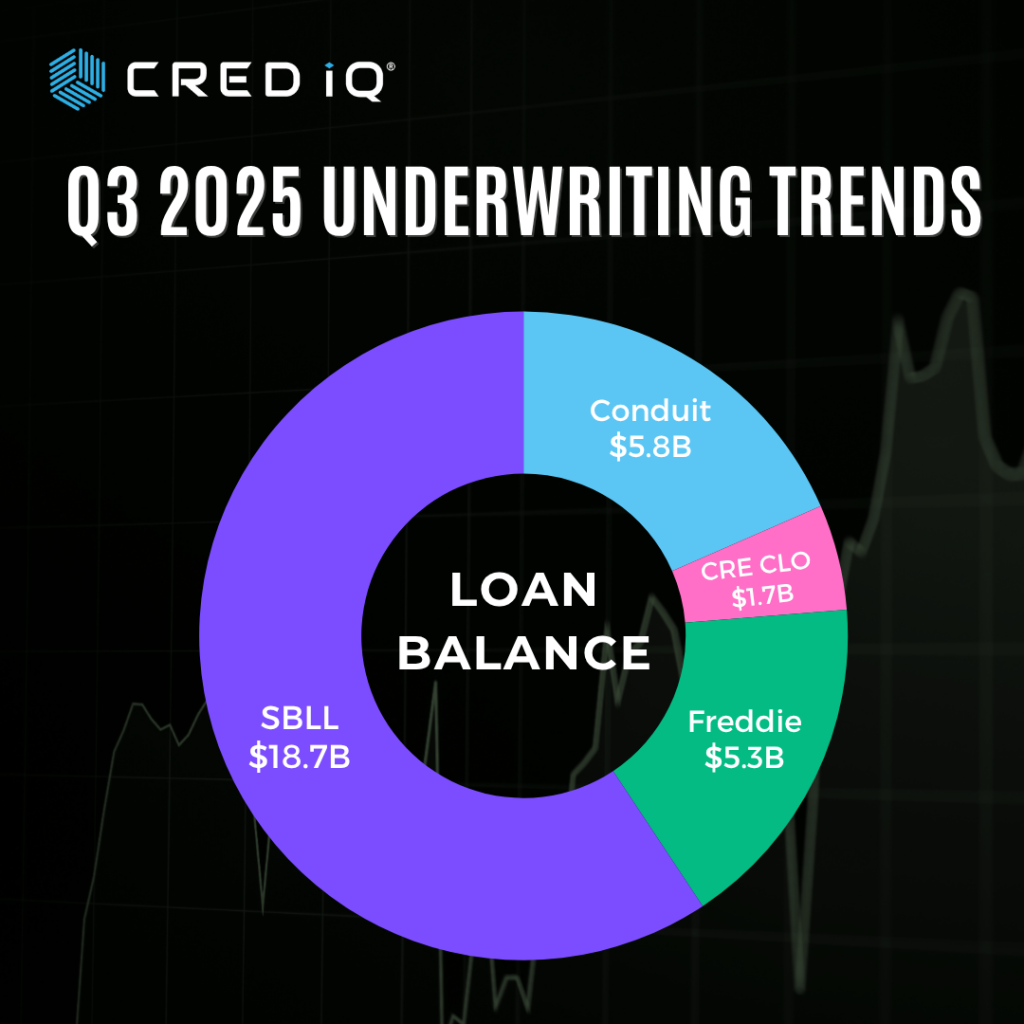

With this transaction, full-year 2025 U.S. conduit volume ends just under $60 billion — virtually unchanged from 2024 and still roughly 40% below the 2017–2019 average. Expect 2026 to remain range-bound unless material rate relief or a surge in transitional lending sparks a meaningful rebound.